This article was published on Arbona Health Hub Volume 1 Issue 1 (ISSN: 3065-5544).

Private equity (PE) ownership has been a growing trend in the healthcare industry, raising questions about its implications for patient care and the healthcare system as a whole. Private equity in healthcare is a form of for-profit ownership of hospitals/medical centers/nursing homes/ etc. that invest in healthcare facilities by raising capital from investors and borrowing the rest. PE firms are often known as “leverage buyouts” because they primarily use debt to finance acquisitions.1

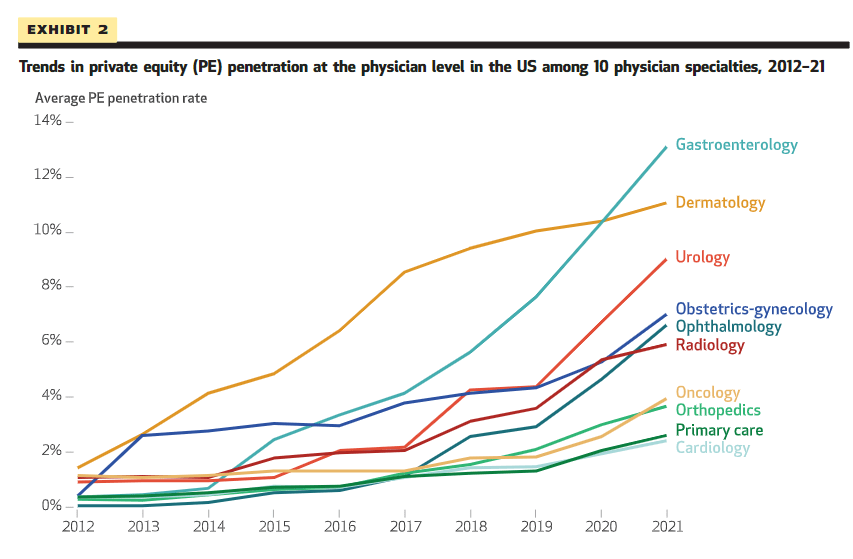

PE investors spent more than $200 billion on healthcare acquisitions in 2021 alone, with $1 trillion invested in the past decade. Investors are largely taking over physician practices, especially in high-margin specialties like dermatology, urology, gastroenterology, and cardiology. A concern is that these firms are monopolizing metropolitan areas. When PE firms acquire multiple providers in the same specialty within a local or regional market, these firms can gain significant market power. This has the potential to lead to higher prices or lower pressure, or both, as a result of reduced competitive pressure. 1,2

Why are private equity firms investing in healthcare?

Several factors are driving PE investment, largely the attraction to earning a piece of the $4 trillion healthcare economy. With low interest rates, there has been low cost of capital, leading to an increase in influx of investors. Additionally, the increasing commercialization of healthcare has opened the door for private investors. While healthcare was traditionally a nonprofit sector, with the increased competition, some nonprofit healthcare organizations have begun to mimic for-profit models. Nonprofit, charitable, healthcare systems are stashing capital reserves (money), and sought near-monopoly power among local markets, enabling them to raise prices. Lastly, PE firms offer fresh perspectives, money, and hope to solve some of the leading problems for American’s health, with rising concerns over the ongoing failure of the U.S. healthcare system to deliver valuable care. 1

Concerns with Private Equity Investment

In a recent Harvard review of PE hospital buyouts, researchers compared how often patients experienced certain outcomes before and after a hospital was acquired by PE. This study found that “after a hospital was acquired by private equity, admitted Medicare patients had a 25% increase in hospital-acquired complications, compared with patients admitted before acquisition. Patients also had 27% more falls and 38% more bloodstream infections caused by central lines, despite private equity hospitals placing 16% fewer central lines than before the buyout.” 3

Additionally, a recent 2023 meta-analysis evaluated the trends in PE ownership on health outcomes, costs to patients or payers, costs to operators and quality, controlling for the risk of bias in study outcomes. The study’s biggest takeaway is that PE ownership is associated with increase in healthcare costs to patients or payers, primarily by increased charges and negotiated higher rates with payers. Also, mixed impacts of PE ownership on healthcare quality, but greater evidence suggesting PE may degrade quality rather than show any improvement. Out of 55 studies in the review, 21 studies identified at least one harmful impact on PE ownership. The most frequent quality measure looked at issues with staffing. PE ownership was associated with almost exclusively negative impacts on patient, satisfaction, daily functioning, and general quality scores. 4

Conclusions

Private Equity investment continues to be a dominant force in the commercialization of healthcare across the United States, however, results on the benefit seem limited, and unchecked regulation causes even more concern. The ability of PE firms to dominate local healthcare markets, with limited regulation or scrutiny from antitrust authorities exacerbates concerns, and leaves communities vulnerable to PE monopoly. With limited supervision from the Federal Trade Commission, state regulators and policy makers, increased policy regulation is needed, while also evaluating the benefits of patient care, safety and satisfaction.

While this article touches on the surface of PE investment across the US, more research is needed to fully understand the impact on health outcomes, system costs and how this model compares to other non-US settings. Longitudinal studies are needed to understand the full effects of the increasing commercialization of healthcare by PE firms, after this large increase in buyouts from 2021 to now. It is known that PE ownership is widely consequential for every patient, provider and payer involved.

References

- Private Equity’s Role in Health Care: https://www.commonwealthfund.org/publications/explainer/2023/nov/private-equity-role-health-care#:~:text=What%20is%20private%20equity%3F,two%20forms%3A%20private%20or%20public.

- Abdelhadi, O., Fulton, B. D., Alexander, L., & Scheffler, R. M. (2024). Private Equity-Acquired Physician Practices And Market Penetration Increased Substantially, 2012-21. Health affairs (Project Hope), 43(3), 354–362. https://doi.org/10.1377/hlthaff.2023.00152

- https://hms.harvard.edu/news/what-happens-when-private-equity-takes-over-hospital

- Borsa, A., Bejarano, G., Ellen, M., & Bruch, J. D. (2023). Evaluating trends in private equity ownership and impacts on health outcomes, costs, and quality: systematic review. BMJ (Clinical research ed.), 382, e075244. https://doi.org/10.1136/bmj-2023-075244

[…] R. Arsenault examines the increased commercialization of healthcare through private equity (p. […]

LikeLike