This article was published on Arbona Health Hub Volume 1 Issue 2 (ISSN: 3065-5544).

I thought it would be interesting to dive into the current state of insurance practices in the United States and the resounding negative sentiments toward the US healthcare system. With the United States spending the most per capita on healthcare and being a world leader in healthcare innovation, there are still 30 million Americans with no health insurance and many more underinsured (Alpert, 2023). Due to the complexities of the insurance system, Americans are eligible for different types of coverage depending on whether their employer offers it or not, income level, age, and healthcare needs. These categories fall into employer-sponsored insurance, private coverage, Medicare and Medicaid, all of which have complexities in how much coverage is offered and how much someone has to pay out of pocket (Collins, 2022).

Because the United States does not have any autoenrollment mechanisms for insurance, Americans who are not under employer-sponsored insurance must figure out what programs they are eligible for and then go through the enrollment process, which can be lengthy and complex (Collins, 2022). This is where other problems also sink in, as U.S. health literacy is very poor. The Milken Institute has found that at least 88% of adults in the US have inadequate health literacy to navigate the healthcare system, with 14% of adults with below basic proficiency. This leads to complications in understanding how to enroll in insurance coverage and lack of understanding in following medical advice, leading to worsening health outcomes (Alpert, 2023).

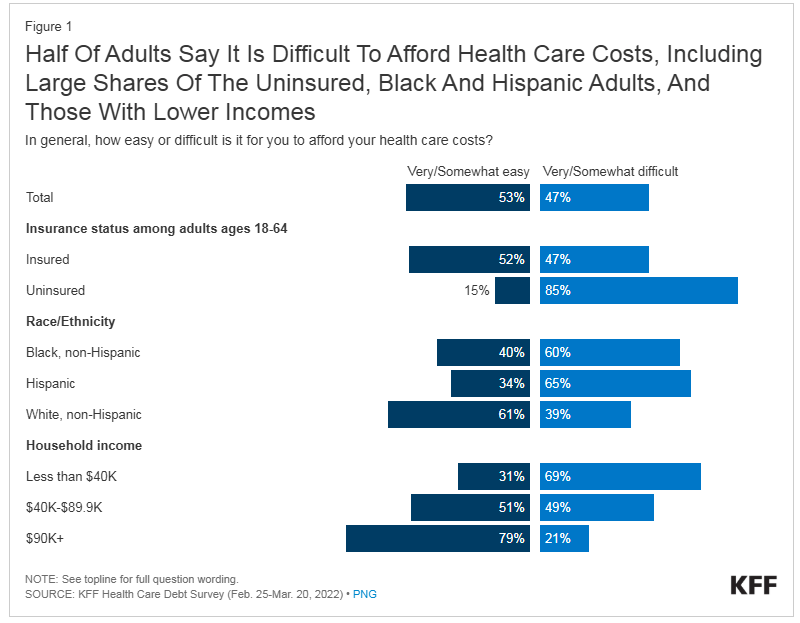

Americans’ Challenge with Health Care Costs- A Report by the Kaiser Family Foundation

Source: https://www.kff.org/health-costs/issue-brief/americans-challenges-with-health-care-costs/

American families have trouble affording healthcare costs, with high deductibles, copays, out-of-pocket costs, unexpected bills and prescription drugs. In today’s landscape, about half of U.S. adults say that it is “very or somewhat difficult” for them to afford their healthcare costs (47%), and this percentage rises among adults un-or underinsured, older, or Black and Hispanic. At least 60% of Black and 65% of Hispanic adults report difficulty affording health care costs compared to 39% of White adults. Particularly, affording healthcare is a problem for those who need it most, as those who describe their health as “fair” or “poor” say they or a family member had problems paying for healthcare in the last year, with 51% of uninsured adults saying they are in fair or poor health (Lopes, 2024).

Lack of good health insurance, and high cost of care is leading to adults skipping or delaying seeking services. One-quarter of adults say they have skipped or postponed healthcare because of the cost, with the number rising to 36% of adults skipping or delaying care among those uninsured. Even those with insurance, 21% still reported not getting healthcare needed due to cost (Lopes, 2024). In a report by the Commonwealth fund, as much as 25% of people with chronic health problems, like diabetes, said that out-of-pocket costs for prescription drugs to treat their illnesses had caused them to skip doses or not fill a prescription for their conditions (Collins, 2022). This is worrisome and it highlights the compounding effects of cost barriers on long-term health outcomes. Skipping necessary treatments or medications, especially for chronic conditions, can lead to worsening health, increased and unnecessary hospitalizations, life-threatening complications and further adds to avoidable healthcare costs. This cycle not only exacerbates the individual’s health challenges but also places a heavier financial burden on the healthcare system overall by costing billions of dollars for emergency treatments (Rohatgi, 2021).

About half (48%) of insured adults worry about affording their monthly insurance premiums, and many with employee-sponsored or marketplace coverage rate it “fair” or “poor” in terms of the costs still associated with seeing a medical professional. This goes to show that all Americans’ no matter having coverage or not, are not immune to burdens of the healthcare insurance system. Healthcare debt is a wide reaching problem for U.S. adults, with 41% having some sort of debt due to medical or dental bills past due or unable to pay. These staggering statistics illuminate the growing and ever-present hardships for American adults in dealing with the healthcare system and the fear surrounding the possibility of not being able to pay off medical costs (Lopes, 2024). These issues are disproportionately affecting low income and marginalized populations across the US.

Lacking Administrative Efficiency and Insurance Claim Denials

Even with these high costs, this does not indicate better administrative efficiency, therefore U.S. physicians and patients are most likely to face hurdles related to insurance rules, billing disputes, and paperwork (Blumenthal, 2024). In this context, administrative efficiency focuses on the challenges doctors have in dealing with insurance or medical claim issues, reporting and charting, and patients’ time spent disputing medical bills. Due to the U.S.’s complex system of different public and private insurances, there are thousands of health plans that all have different requirements. Therefore, physicians and providers in the US spend the most amount of time and effort billing the different insurance systems compared to other countries.

On top of this, denials of services are common, requiring more time and effort from all parties on appealing the decisions, with many not challenging the denial and not getting care their doctor recommends (Blumenthal, 2024). Claim denials take a toll on patients’ health and delay or prevent care. This not only causes worry and anxiety about getting the care they need, but their health problems worsen in the interim or delay diagnosis to get the proper treatment (Commonwealth Fund, 2024).

“Serious health and financial consequences arise as a direct result of insurance problems, and consumers whose problems include denied claims are far more likely to have needed care delayed or denied, to experience a decline in health status, and to face higher out-of-pocket costs,” according to a report on the KFF survey. Source: Pollitz, 2023

Conclusions

These statistics underscore the urgent need for systemic policy changes that address affordability and proper insurance coverage. No one should have to choose between financial stability and their health. Policymakers and healthcare executives must explore strategies to lower out-of-pocket costs, improve prescription drug affordability, and expand insurance coverage to reduce the barriers preventing individuals from accessing necessary care. Programs like Medicaid expansion under the Affordable Care Act have demonstrated success in improving access for vulnerable populations, but gaps remain, particularly in states that have not adopted these measures.

Addressing this issue requires a multilayered approach at all levels starting from congressional legislation, how insurance network systems are run, and school systems teaching health. Systematic changes at these points will contribute to changes all the way down, from business meetings, to the exam room between a provider and a patient. Patient education is a high priority as surveys show there is considerable consumer confusion among patients and their families about their right to appeal and who to contact in insurance denial cases. Equitable transparency, education and standardization is needed to ensure providers and patients know their rights on denial decisions and how to get the care they need– reducing these barriers is a step in the right direction. Additionally, customer assistance programs would benefit patients in submitting an appeal as the process can be complex (Commonwealth Fund, 2024).

By creating a system that prioritizes preventive care, the U.S. could reduce the long-term costs associated with avoidable hospitalizations and poor health outcomes, benefiting both individuals and the healthcare system as a whole. Such reforms could shift the focus of the U.S. healthcare system from reactive, high-cost interventions to a proactive, patient-centered model—one where seeking care is not a luxury but a fundamental right.

References

- Alpert J. S. (2023). Twenty-First Century Health Care Challenges in the United States. The American journal of medicine, 136(7), 609–610. https://doi.org/10.1016/j.amjmed.2023.01.002

- Collins, S., Haynes, L., & Masitha, R. (2022, September 29). The state of U.S. health insurance in 2022. Commonwealth Fund. https://www.commonwealthfund.org/publications/issue-briefs/2022/sep/state-us-health-insurance-2022-biennial-survey

- Lopes, L., Montero, A., Presiado, M., & Hamel, L. (2024, March 1). Americans’ Challenges with Health Care Costs. Kaiser Family Foundation. https://www.kff.org/health-costs/issue-brief/americans-challenges-with-health-care-costs/

- Rohatgi, K. W., Humble, S., McQueen, A., Hunleth, J. M., Chang, S. H., Herrick, C. J., & James, A. S. (2021). Medication Adherence and Characteristics of Patients Who Spend Less on Basic Needs to Afford Medications. Journal of the American Board of Family Medicine : JABFM, 34(3), 561–570. https://doi.org/10.3122/jabfm.2021.03.200361

- Blumenthal, D., Gumas, E. D., Shah, A., Gunja, M. Z., & Williams II, R. D. (2024). Mirror, Mirror 2024: A Portrait of the Failing U.S. Health System. The Commonwealth Fund. https://doi.org/10.26099/ta0g-zp66

- Unforeseen Health Care Bills and Coverage Denials by Health Insurers in the U.S. (2024). Commonwealthfund.org. https://doi.org/10.26099/jqpw-jz55

- Pollitz, K., Pestaina, K., Lopes, L., Wallace, R., & Published, J. L. (2023, September 29). Consumer Survey Highlights Problems with Denied Health Insurance Claims. KFF. https://www.kff.org/affordable-care-act/issue-brief/consumer-survey-highlights-problems-with-denied-health-insurance-claims/